Expense Data and Reporting

Enriched expense data and streamlined reporting at your fingertips

Instantly access expense data from all your banking

partners and streamline business spending with our centralised platform.

Integrated with 1000s of partners

Data and insights in one convenient place

Keep your financial data secure, organised and easily accessible with our centralised platform.

-

Consolidate expense data

Access a comprehensive overview of expenses and connect all your accounts. This makes it easier to identify spending patterns, trends, and areas for optimisation.

-

Auto-reconciliation and reporting

Have complete visibility of your business expenses. Our automated systems match purchase data to your payment data daily and present it online in a single view.

-

Customisable file formats

Receive daily files and export them in customisable formats so your business can seamlessly tailor the exported expense data to fit its existing systems and processes.

How our expense data and reporting platform helps your business

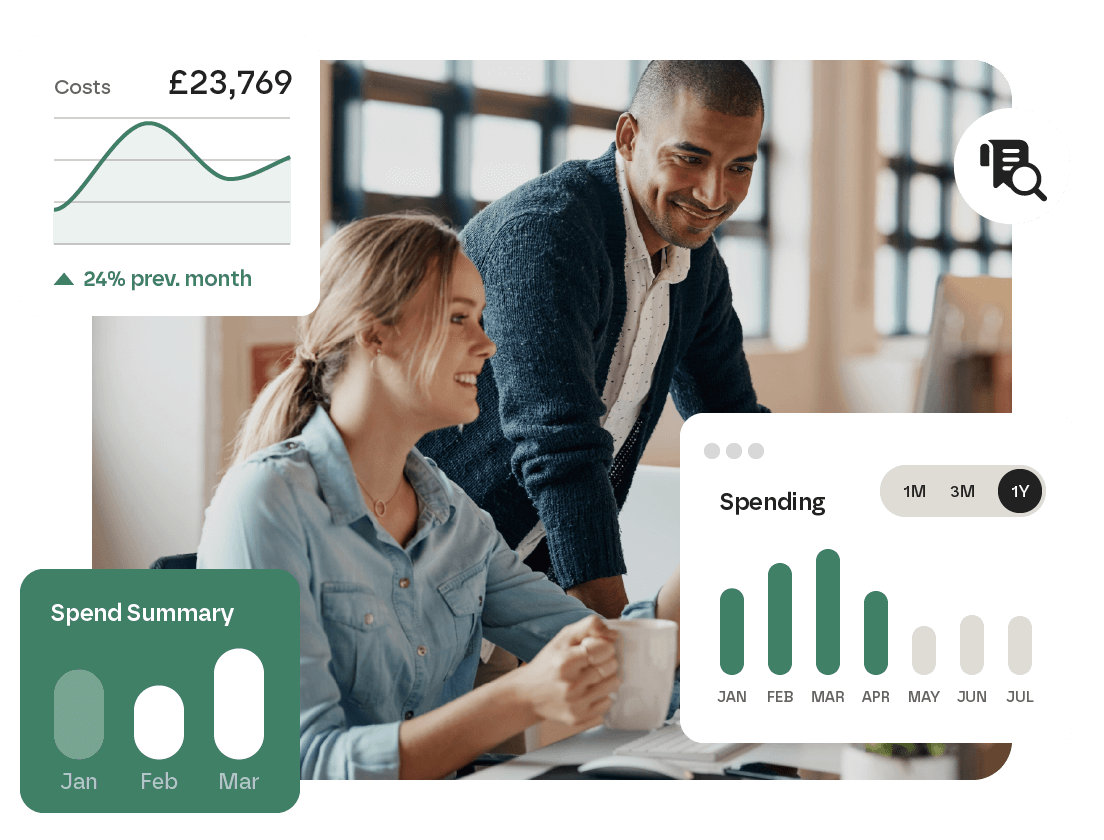

Instant visibility to expense data

Track and monitor expenses at a granular level, including transaction amounts, vendor information, and spending categories. This allows you to make better financial decisions as you can identify spending trends, areas of overspending, and opportunities for cost optimisation.

Manage expense reporting in one place

Have one place to view your expense data. Instead of managing and tracking expenses across multiple systems, our platform consolidates and tracks expenses in one single location, so they’re instantly reconciled and easy to analyse.

Making corporate finances more efficient

With greater visibility into expenses and spending trends, you can identify areas of excessive spending, negotiate better contracts with vendors, and enforce expense policies. This helps to optimise costs and drive financial savings.

Partnered with trusted businesses worldwide

We collaborate with global travel management companies, trusted banks, online booking tools, and global distribution systems to deliver safe and secure payment solutions for businesses worldwide.

How does Conferma centralise your reports?

Discover how our centralised platform provides real-time insights and manages your financial data efficiently.

-

01

Data integration

Our platform integrates with various payment sources, travel management systems, and other financial systems at your business. Seamless integration allows our platform to collect all your expense data, so you don’t need to input admin and reconciliation manually.

-

02

Data consolidation

Once the expense data is collected, we consolidate it into a centralised source. The platform aggregates the data from different sources and standardises the format. This consolidation ensures that all the expense data is easily accessible from one location.

-

03

Centralised reporting

With the expense data consolidated in one place, businesses can now generate centralised reports. The platform provides customisable reporting capabilities, allowing users to create tailored reports based on their business needs and preferences.

See how we’ve helped businesses like yours

View all case studiesAmerican Express Global Business Travel

AMEX GBT - End to end automated data enrichment and invoicing with Conferma snap+.

Read case study

Explore more of Conferma’s platform

Making your industry our business

Our payment technology helps organisations across different industries.

Discover how we can help your business vertical.

Expense data & reporting FAQs

-

How can I export the data?

You can either use our reporting web portal, or we can provide reports via SFTP that can be integrated into your financial system.

-

Can I get the enriched data from my bank?

Yes, in most cases, Conferma automatically synchronises the enriched transaction data with your preferred bank. This allows you to access that data via your bank’s reporting tool. Contact us for more information on which data we synchronise with your bank.

-

How often does Conferma receive payment data updated?

Conferma receives automatic payment data daily, so you can instantly post the transactions to your ERP.

-

What are the benefits of tracking expense data?

With Conferma’s expense data and reporting platform, businesses get enhanced visibility, control, and accuracy over corporate spending. Through real-time tracking, businesses can proactively manage expenses and make timely decisions based on accurate data.

But that’s not all. Expense tracking also improves overall expense management, ensures compliance, and generates valuable insights for cost optimisation. Streamlined reporting and analysis provide actionable insights, while increased financial control and data-driven decision-making improve financial efficiency.

-

How does Conferma’s expense data and reporting platform make finance teams more efficient?

Our expense data and reporting platform automates the manual processes involved with expense management, such as data entry, reconciliation, and approval workflows. This automation reduces the time and effort needed for finance teams to handle routine tasks so that they can focus on more strategic and value-driven activities.

-

Can refunds be tracked and accounted for too?

Yes, refunds can be tracked and accounted for in Conferma’s expense data and reporting platform. The platform allows businesses to capture and record refund transactions, ensuring they are accounted for in the expense data.

Book a virtual credit card demo

Book a demo with Conferma and discover how virtual cards can optimise your payment system.