Business Payment Solutions

Make your B2B payment processes more efficient

Embed our payment solutions into your procurement processes to efficiently manage your business payments.

Integrated with 1000s of partners

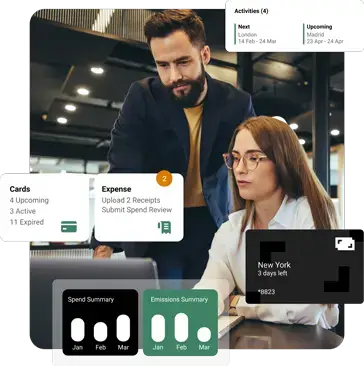

Managing corporate spending is simple with virtual business credit cards

-

Control your cashflow

Streamline payment processes, reduce admin, and improve cashflow using a credit account with your preferred banking partner.

-

Improve spending controls

Set limits on single-use virtual cards to pay specific business payments. This simplifies expense tracking. Reduces the risk of fraud and unauthorised transactions. And ensures your business has accurate reporting.

-

Simple integration

Choose an integration path that works for you. Use Conferma’s web portals to generate payments or integrate through our existing connected ecosystem or API.

-

Automatic reconciliation

Avoid manual business payment reconciliation and streamline enriched data into your existing payment processes. This automated feature simplifies expense management and provides you with accurate financial reconciliation.

Benefits for business spend management platforms

One simple, secure connection

Tailor our payment systems to your business needs. Connect to your customers’ virtual card accounts through one simple gateway, enabling them to pay their suppliers securely and quickly.

Enriched data reporting

Improve payment processes with actionable enriched reporting data. Plus, it protects your customers against exchange rates thanks to our localised bank partners.

Benefits for businesses to improve financial efficiency

Improve cash flow and supplier relationships

Virtual cards reduce the time payments take to clear, strengthening your supplier relationships. Avoid legacy payment methods, such as ACH and cheque. And make ad-hoc supplier payments easier with complete protection by avoiding lengthy pre-screening processes.

Improve spend visibility with our B2B ecosystem

Get complete visibility into your expenses with automated reconciliation. This feature gives you a line-by-line breakdown of enriched data to help improve your payment processes and accounts. Our solutions seamlessly adapt to suit any B2B payment needs, so you can enjoy a tailored payment solution that aligns with your unique business requirements.

Partnered with trusted businesses worldwide

We collaborate with global travel management companies, trusted banks, online booking tools, and global distribution systems to deliver safe and secure payment solutions for businesses worldwide.

Explore Conferma’s platform

Business payments FAQs

-

Can you choose between exchange rates when travelling?

Yes, we collaborate with banks that provide foreign and native exchange rates, ensuring you receive the best rates and incentives.

-

How can expenses be tracked and reclaimed with Conferma?

Expenses are easily tracked and reclaimed with our payment solutions. That’s because virtual credit cards are linked to specific transactions or expenses, with automated reporting capturing real-time data. Expenses can also be categorised for streamlined tracking, simplifying reconciliation and allocation.

-

Can startup businesses benefit from Confermas solutions?

aDui quis velit nam mauris curabitur gravida amet aliquet. Ac quam sit cras velit cursus sit. Id nulla faucibus amet tellus faucibus. At iaculis non fusce dictum in suspendisse. Dui eu mattis velit adipiscing sit arcu quisque sagittis. Varius vel eget auctor scelerisque.

Business Payments solutions demo

Discover how our business payment solutions could optimise your current system.